An Edinburgh fintech company has won government support to help create a greener future for homeowners.

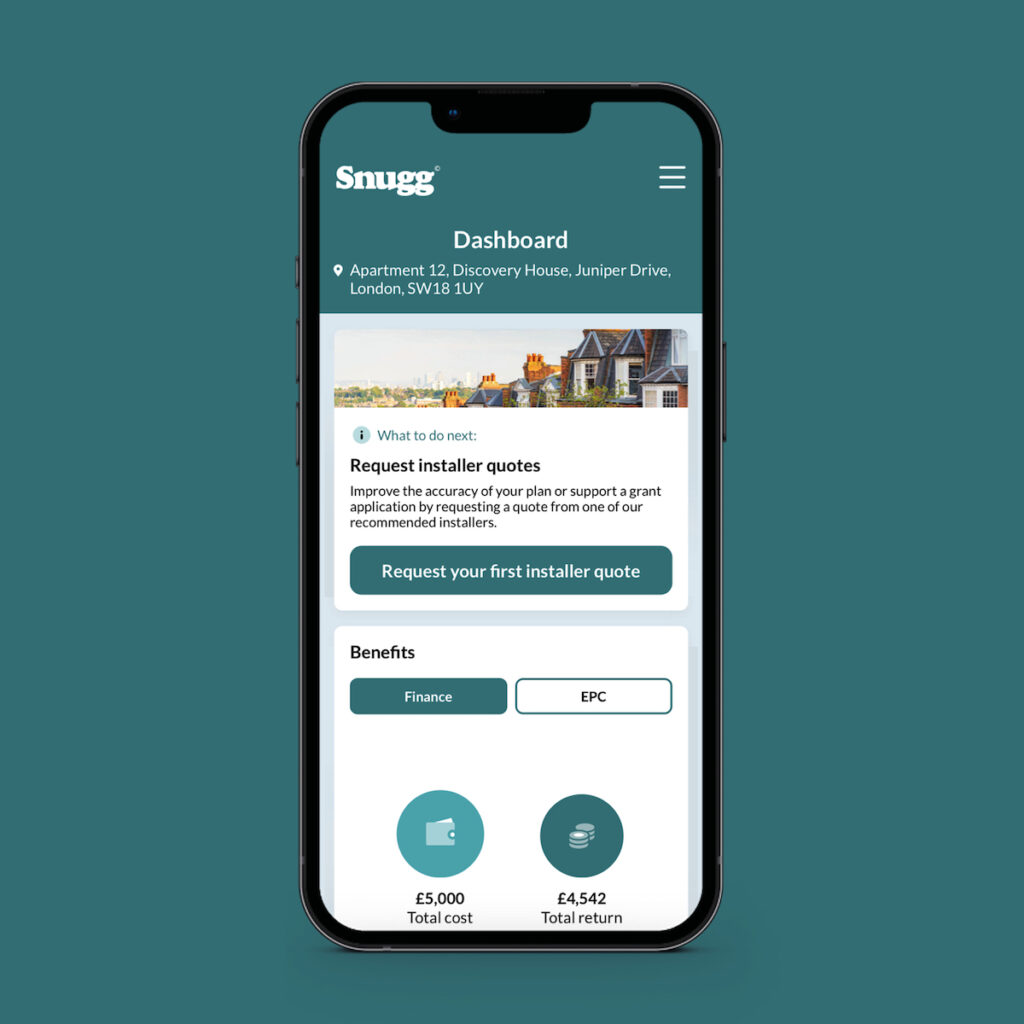

Snugg, an innovative tech platform focused on giving data-driven insights on consumers to banks and energy providers, has won a ‘significant’ government grant to develop the product.

The firm will use the funding to develop a ‘Green Home Hub’ that will help finance providers better understand the needs of customers who are considering investing in home energy improvements, and transform the investment decision from a “no-hoper” to a “no-brainer”.

It announced that is has secured funding from the UK Government’s Green Home Finance Accelerator (GHFA) programme – a £20m innovation fund for the development of green finance products which can enable the uptake of home energy efficiency and low carbon heating measures.

Specifically, the funding will be utilised to develop the platform to help finance providers better understand the needs of customers hoping to upgrade their homes with solar panels and heat pumps, and offer more suitable products.

Snugg CEO, Robin Peters, said, “We’re thrilled to have secured the Green Home

Finance Accelerator grant. It’s a significant leap forward in our mission to make home

energy efficiency simple and accessible for all.

“Through the development of the Green Home Hub, we’re poised to transform the narrative around home energy investment from a ‘no-hoper’ to an absolute ‘no-brainer’. We’ve already been aligning our approach with several key players (including Trustmark, Nesta and HSBC). Now, we’re eager to collaborate with more industry participants as we aim to reach thousands more homeowners and accelerate our collective journey towards Net Zero.”

The forthcoming Green Home Hub is an innovative approach to supporting Snugg’s

partners, including banks and energy providers. It will provide rich data insights,

including:

● High-quality cost estimates (high costs are one of the biggest barriers to

people implementing energy efficiency measures)

● Grant application wizard (grants, where available, are often highly complex in

terms of what they cover and are very difficult to apply for)

● House value impact modelling (the impact on house price is a significant factor

when people decide whether to invest in home energy improvements)

● Plan progress tracking and ‘nudging’ (many people are reluctant to spend

significant amounts of money on energy efficiency improvements unless they

have confidence that this is a sound investment)

● Fuel savings monitoring (establishing a feedback loop through the smart meter

will help people implement their efficiency improvement plans in stages, getting

comfortable that each investment has been worthwhile)

● Carbon reduction tracking (creating an opportunity for people to benefit

financially from their contribution to carbon reduction)

The Green Home Hub will be licensed to partners, allowing Snugg to extend its reach

and make a more significant environmental impact by reaching thousands more

homeowners across the UK.

By addressing the barriers homeowners face when considering energy-efficient

upgrades, the Green Home Hub aims to help financial providers better understand their

customers and develop more suitable products, from mortgages to savings accounts.

The goal is to transform energy-efficiency upgrades into a clear choice rather than a

complicated decision.

Lord Callanan, Minister for Energy Efficiency and Green Finance, said: “The government has put in place long-term commitments to ensure homes across the country have greater energy efficiency to reduce bills, drive down energy use and lower emissions. We are supporting these organisations to develop fresh and innovative ways of helping more people get better access to energy efficiency measures, such as loft insulation, double glazing and heat pumps.”